Harnessing Fibonacci Retracement for Technical Analysis on MT4

In the world of forex trading, understanding price trends and potential reversal levels is crucial for success. The Fibonacci retracement tool is a powerful ally that empowers traders to achieve this level of analysis. This article delves into the strategies and benefits of using Fibonacci retracement for technical analysis on the MetaTrader 4 (MT4) platform.

Unveiling Fibonacci Retracement

Fibonacci retracement is a technical analysis tool that helps traders identify potential support and resistance levels based on the Fibonacci sequence. The tool employs horizontal lines that indicate key price levels where a market retracement might end and a new trend could begin.

“Fibonacci retracement levels act as a compass, guiding traders to potential price reversal points and aiding in decision-making.”

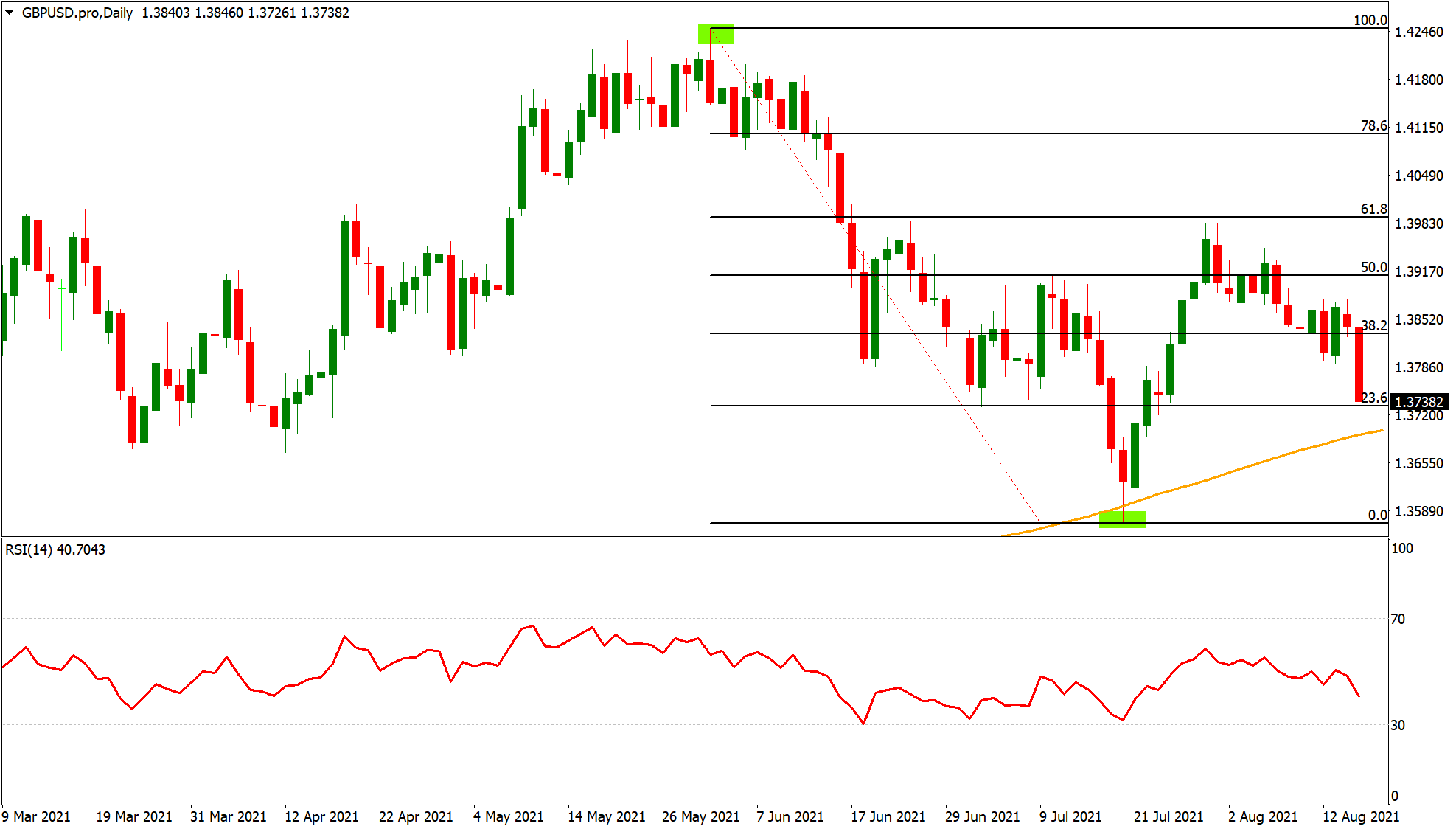

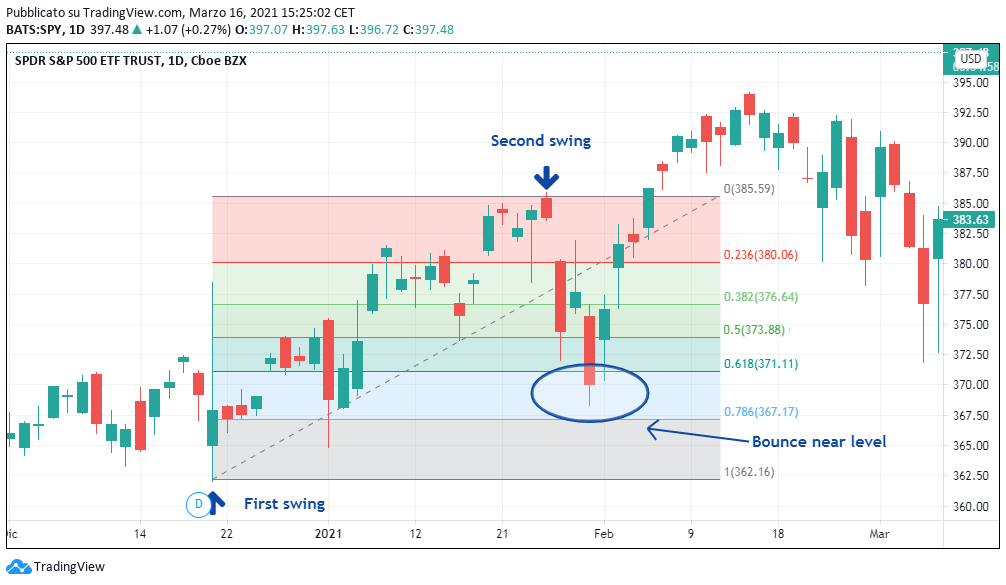

The key Fibonacci retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are derived from the mathematical sequence where each number is the sum of the two preceding ones. The tool is particularly effective during trending markets, offering traders insights into potential price pullbacks and trend continuation points.

Integrating Fibonacci Retracement on MetaTrader 4 (MT4)

MetaTrader 4 (MT4), renowned for its user-friendly interface and comprehensive tools, is an ideal platform for traders seeking to harness the power of Fibonacci retracement. Adding the Fibonacci retracement tool to your MT4 charts is a seamless process, enabling you to perform detailed technical analysis with ease.

“The integration of Fibonacci retracement on MT4 streamlines the process of identifying key price levels for traders, enhancing their analytical capabilities.”

MT4 ensures that traders of all experience levels can effortlessly incorporate technical tools like Fibonacci retracement into their trading strategies. The platform’s intuitive design allows you to focus on refining your trading analysis rather than grappling with the technology.

Strategies and Benefits of Fibonacci Retracement

The Fibonacci retracement tool is versatile and can be utilized in various trading strategies. When combined with other technical indicators and price patterns, it enhances the accuracy of predicting potential reversal points. Traders often look for confluence between Fibonacci retracement levels and other forms of support and resistance.

“Leveraging Fibonacci retracement allows traders to make more informed decisions, capitalizing on price movements with precision.”

Additionally, Fibonacci extensions can be used to project potential future price levels beyond the initial retracement. This can aid in setting profit targets and identifying potential trend continuation points.

Conclusion: Elevating Technical Analysis with Fibonacci Retracement

As a forex trader, mastering the art of technical analysis is pivotal for success. The Fibonacci retracement tool empowers you to analyze price trends and predict potential reversal levels with enhanced precision. By seamlessly integrating Fibonacci retracement into the MetaTrader 4 platform, you equip yourself with a powerful resource for making well-informed trading decisions.

As you navigate the intricacies of forex trading, let Fibonacci retracement be your guiding tool, offering you insights into potential support and resistance levels. With dedicated practice and a deep understanding of its applications, you’ll be well-prepared to seize opportunities, optimize your strategies, and elevate your technical analysis skills to new heights.