Practical Guide to Utilizing RSI for Price Prediction on MT4

In the realm of forex trading, predicting price movements accurately is the key to success. One tool that has proven its worth time and again is the Relative Strength Index (RSI). This article serves as a practical guide to leveraging the power of RSI for price prediction on the MetaTrader 4 (MT4) platform.

The Essence of the RSI Indicator

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically displayed below a price chart. RSI values above 70 indicate overbought conditions, suggesting that the asset may be due for a price correction or reversal. Conversely, RSI values below 30 suggest oversold conditions, potentially signaling an upcoming price rebound.

“The RSI indicator is a window into market sentiment, offering insights into potential trend changes and reversals.”

Understanding the dynamics of RSI can empower traders with the ability to identify pivotal moments in price trends. Integrating RSI into your trading strategy can provide valuable confirmation when analyzing potential entry and exit points.

Integrating RSI on MetaTrader 4 (MT4)

MetaTrader 4 (MT4) stands as a beacon of convenience and functionality for forex traders. Adding the RSI indicator to your MT4 platform is a straightforward process that enriches your trading arsenal. With the RSI indicator integrated into your charts, you gain the ability to track and analyze the momentum of price movements in real time.

“MetaTrader 4’s user-friendly interface allows traders to harness the power of RSI seamlessly.”

Whether you’re a seasoned trader or a novice, MT4’s intuitive platform facilitates a smooth learning curve, ensuring that you can make the most of technical indicators like RSI. This integration brings the power of RSI right to your fingertips, enhancing your decision-making process.

Putting RSI to Practical Use

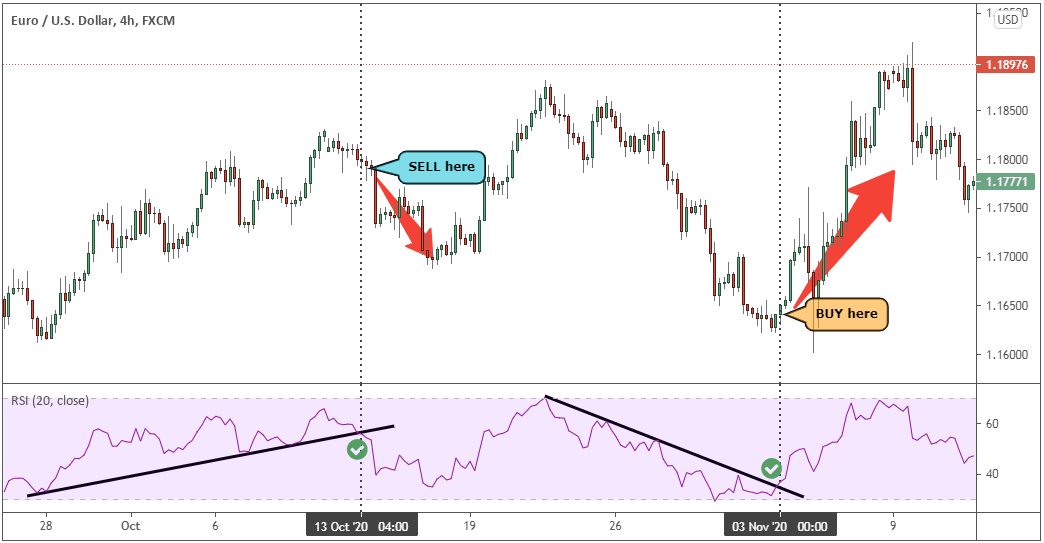

While RSI can be a powerful tool, like any indicator, it’s most effective when used in conjunction with other analysis techniques. Combining RSI readings with trendlines, support and resistance levels, and other indicators can provide a more comprehensive view of the market.

“The real magic of RSI lies in its ability to confirm trends and potential reversals, enhancing the accuracy of your trading decisions.”

For instance, if the RSI indicates an overbought condition (RSI > 70) while the price approaches a strong resistance level, it may suggest that a price reversal could be imminent. Similarly, an oversold condition (RSI < 30) in conjunction with a bullish trendline might signal a potential buying opportunity.

Conclusion: Elevating Price Prediction with RSI

Mastering the art of price prediction is a paramount goal for forex traders, and the RSI indicator is a valuable asset in this pursuit. By understanding the nuances of RSI and integrating it into the MetaTrader 4 platform, you can gain insights into market sentiment and potential trend changes. Remember that while RSI is a powerful tool, combining it with other analysis methods can provide a more holistic understanding of market dynamics.

As you embark on your forex trading journey, let the RSI indicator be your guide, aiding you in making more informed trading decisions and ultimately contributing to your success in the dynamic world of forex trading.