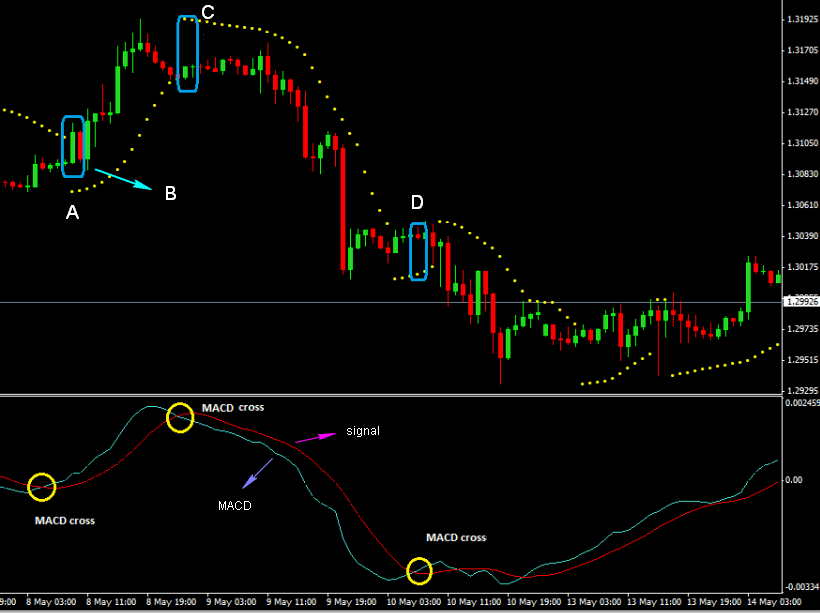

Point A: the movement of the pSAR point changes position from above the price to the bottom of the price, indicating the signal for the buy entry or signal to exit sell.

Point B: Place the buy stop order as soon as the MACD curve intersects the signal curve from the bottom up (signal to buy), and the pSAR point changes from above price to price (A).

Point C: the movement of the pSAR point changes from below the price to the top of the price, which indicates a signal for the sell entry or a signal to exit buy.

Exit the buy position, and or place sell sell orders as soon as the MACD curve intersects the signal curve from the top down, and the pSAR point changes from below price to price (C).

Point D: Exit a sell position, and or place a buy-stop order as soon as the MACD curve intersects the signal curve from the bottom up, and the pSAR point changes from above price to price.

4. If at the same time there is no MACD cross and pSAR point position change then there is no order placement.

5. Stop loss can be determined at the nearest support or resistance level, and adjusted to the planned risk management .

This method will work well when the market is trending strongly.